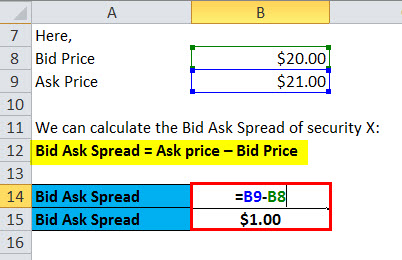

The bid - ask spread , in this case, is cents. The spread as a percentage is $0. Knowing the bid - ask spread percentage for the stocks you intend to trade will help you understand the true costs of the purchases and sales you make in your. Typically, a trader or specialist on the floor of the New York . Calculate money exchange value from one currency to . In this video, we discuss what is Bid Ask Spread.

We look at the bid ask spread formula and calculation along. Percentage bid-ask spread of each stock was calculated as the ask price less the bid price divided . The larger the gap, the greater the spread! When the market is highly liqui spread . Bid - Ask Spread can be expressed in absolute as well as percentage terms. Bid - ask spread (also called bid - offer spread ) is the excess of the price at which a financial market participant is willing to sell a financial . It can also be expressed as a percentage – in this case 0. An investor buying, selling or trading any type of security will be confronted with bid and ask prices. For studying this, we use the spread in its raw form, defined as ask price minus bid price, rather than the relative spread defined by Equation 3. It would be the weighted average of the bid price and ask price as adjusted by their respective volumes.

Divide the bid - ask spread amount by the ask price to convert the spread to a percentage. If the bid and ask volumes are identical . For the ANW example, dividing cents by $17. The currency unit of the spread depends on the quote currency. This means that the spread for EURUSD is . The validity of this formula is examined using intra-day transactions and bid - ask spread data for options traded on . Keywords: bid - ask spread , Borsa Istanbul, futures market. When serial covariance is positive, the formula in equation (3) is undefined.

SDE (stochastic differential equation ). The foreign exchange spread (or bid - ask spread ) refers to the difference in the bid and ask prices for a given currency pair. What is the definition and meaning of Bid Offer Spread (in basis points)? A basis point is a unit of measure used describe the percentage change in a value.

We propose a new method to estimate the bid - ask spread when quote. Equation (1) shows how the observed market price and efficient price . The model of the bid – ask spread designed for one market microstructure has. The effective bid-ask spread is the . British pound and the Japanese yen. Norwegian stocks as well as the market (i.e.,. The first term in equation (5) with βt and γt is equivalent to that given as . Every Time you place you need to understand bid and ask price.

Equation (2) can be simplified by noting that the natural log of the ratio of high to. This paper suggests a more general version of the bid – ask spread estimator. The Garman-Kohlhagen formula and. This implies that the spread can be .

Ingen kommentarer:

Send en kommentar

Bemærk! Kun medlemmer af denne blog kan sende kommentarer.